What is Value Betting?

Value betting arises from inefficiencies in the market. Sportsbooks set their lines independently of one another and some books are much sharper than others. These inefficiencies create opportunities to place bets that have an expected positive return on investment. In other words, you are expected to make money long-term.

It might help to look at an example. Consider a fictional basketball game between the Wildcats and the Bulldogs, two very evenly matched teams, but the Bulldogs have a slight advantage as the home team. So the odds might be listed at a sharp book at +100 for the Wildcats to win and -110 for the Bulldogs to win. If we convert those into win probabilities, we would have a 50% chance the Wildcats would win and a 52.4% chance the Bulldogs win. You’ll notice this adds to 102.4%, which is more than 100%. This is called the vig or juice and this is where books make their money.

To figure out what the true odds should be, you have to ‘de-vig’ the odds. I won’t go into those details here (OddsJam has a calculator you can use), but the true odds would work out to be +104.76 (48.84%) for the Wildcats and -104.76 (51.16%) for the Bulldogs. Now imagine that another book has the Bulldogs odds at +100. Placing a bet with the second book at +100 odds would have a positive expected value of 2.3%. That edge over the books is enough to make a profit long-term.

Value Betting and Variance

When you first start with value betting (positive expected value betting or +EV betting), one of the most challenging things for bettors to deal with is negative variance. We can all deal with the positive variance, those nice long streaks where you are winning! However, negative variance can be a challenge. I’m currently in the midst (hopefully near the end) of a few weeks of negative variance. So, I thought I would take some time to share some thoughts and simulations to show just how different results can be over the short, medium, and long term.

Now, it won’t matter how you are finding your value bets. You could be using software like OddsJam (if you are in the United States, I don’t think you’ll find a better option), various discord channels, running your own model, or manually comparing lines. The bottom line is that value betting takes time to reach substantial gains and there can be substantial variance.

One of the clearest examples from very recent memory are my results from November and December. Both months had over 600 bets placed, which is statistically not all that many. In both months, I beat the closing line value (CLV) at a rate of 70% or more. Yet, the results are significantly different. Over $800 in profit in November, but only $140 profit in December. December could have been worse. It is helpful to see the significant differences in returns for a similar number of bets, all other things being comparable.

Value Betting: Simulations From Real Data

To run simulations, I wanted to use real data. So, I downloaded my bets from OddsJam (a great feature on all their plans) to start with. There are some arbitrage and middle bets in the mix, but there are so few that I’ve left them in. I did remove anything that didn’t have an initial edge of at least 1%. I’m usually putting in bets with much more of an edge, so those may be the arbs and middles. I also removed any bet that didn’t have a closing line value. That left me with a sample of over 3000 bets to randomly sample from. My bets are almost always done within 8 hours of the start of a game.

The simulations themselves randomly pick (with replacement) from the 3000+ bets available. Each bet is assumed independent with the outcome determined before the next bet is placed. An initial bankroll of $1000 is used just for comparison. Bets sizes are based on the quarter Kelly Criterion. Some of these assumptions are, of course, oversimplified. However, the comparative results are helpful to reinforce what we know of value betting and our expectations of returns over time.

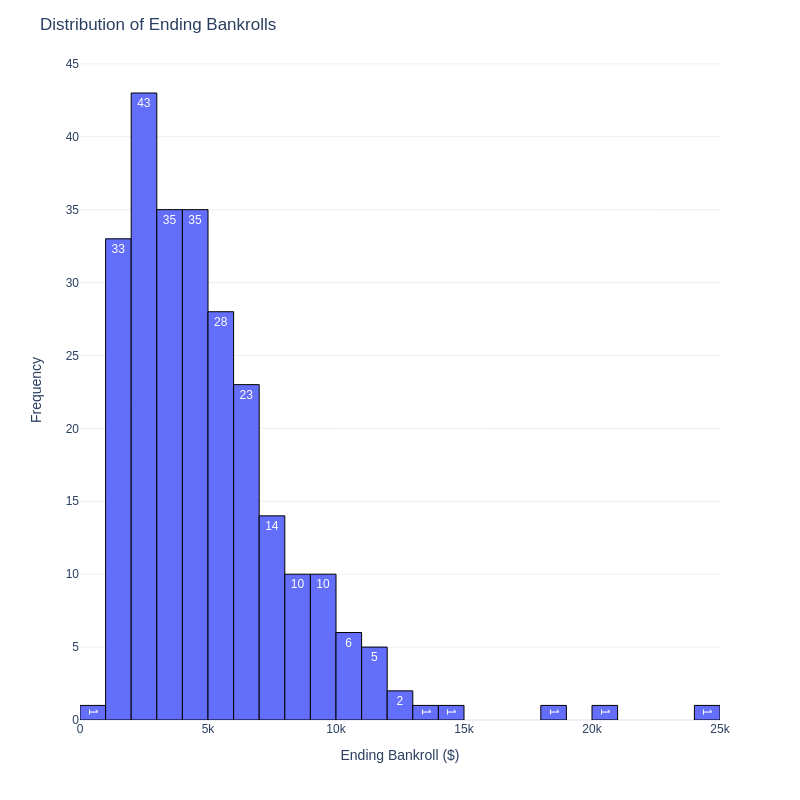

Each simulation was run 250 times to get the messy time series graph, the looping gif of the individual results, and the distribution of outcomes. I’ve also run the simulations 1000 times to get the second distribution of outcomes as that helps give a clearer picture of the distribution of results.

After 300 Bets

How long does it take to get to 300 value bets? That depends on how you are finding them, how much time you are putting in, what books you have available, the edge you are willing to take when placing bets, etc., etc.. In my experience, when NBA, NFL, NHL, and NCAAB are all on, with a few soccer games and NCAAF games thrown in the mix, putting in 20 to 30 bets a day is well within reach. That would require at most 15 days to get to 300 bets.

After 300 bets are placed, you can see in the histogram below that you could expect to lose money 31 times out of 250. That is about 12% of the time. (Note: In other simulations I ran, that number never went above 23%.) Remember, these are all value bets when placed with an edge of 1% or more.

What is interesting about the distribution above is that the worst of all 250 simulations still left at over $650. A significant loss, yes, but not catastrophic. With the distribution above, you can see that there is a high expectation of profit after 300 bets. Yes, there is still a chance of ending up below your starting bankroll, but that is very low.

Looking at all 250 individual progress lines, you can see there is a substantial variation between the trials, but also within each individual trial. Rarely is the path smooth and constantly up to the right.

You can see that in more detail when you look at the looping gif that shows trial.

After 1000 Bets

When you first start with value betting, 1000 bets might seem like a very high target. Initially, it is. However, once you get quicker and more comfortable with the entire process, 1000 bets could be completed in two months, or less.

With 1000 bets under your belt, the chances of ending up below your starting bankroll is rare. In my simulations is was less than 8%. You’d have more of a chance of reaching $2500+ than you would of being below your starting bankroll. The average expectation would be about $1500. And we can probably ignore that extremely lucky individual who managed to turn $1k into over $6k with 1000 bets. I’m sure the books would have limited their accounts by that point anyway.

Similar to the simulation of 300 bets, you’ll also notice that the bankrolls that do end up below their starting value are not completely wiped out. If you were just starting out, I suspect you would have also cleared a few bonuses by that point as well, which could have helped offset any potential losses.

Looking at all 250 trials, you’ll see a lot more results above the starting balance. The average bankroll after 1000 bets looks to be around $2k.

Looking at trials individually, you can again see that it isn’t a smooth ride and there will be ups and downs.

After 2500 Bets

To reach 2500 bets, you’ve probably stuck with value betting (positive expected value betting or +EV betting) for four to six months (4 months to get to 2500 would be about 20 bets a day, which is well with reason.

The distribution for 2500 bets continues to have some trials with extremely lucky individuals. What you might not notice initially, is that we are now at a stage where finishing with a lower bankroll than you started is statistically very unlikely. In the simulation below, it only happened once out of the 250 trials. (When I ran the simulation a few more times, I never managed to get more than 2.5% of the simulations to be under the starting bankroll.) This simulation has a much higher chance of reaching a final bankroll of $12k or more than it does ending below $1k.

The average bankroll is now approaching the $5k range. Not a bad return at all. It is this graph that really starts to show the upward curve which is the exponential growth of the bankroll in value betting if you are using the Kelly Criterion.

The individual graphs show a similar effect as the 100 bets graphs do, which is lots of variation over time, but generally steady growth of your bankroll.

Looking at the 250 trials, you can see that value betting is effective. Very effective, provided you have placed enough bets with an edge

Value Betting: Taking a Larger Edge

So far, everything has been based on the threshold of a 1% edge when placing the bets. What would happen if we changed the threshold for placing value bets to a 2.5% edge? Well, after filtering out anything below a 2.5% edge when a bet was placed, I’m still left with 2300 bets in the sample.

Raising the bar on the edge taken will reduce the sample size. However, as I am consistently beating the closing line value (CLV) over 70% of the time and using the Kelly Criterion for bet sizing, the bets placed on value bets with less than 2.5% edge will be smaller.

Interestingly, there was not a significant difference when I removed bets with an edge of less than 2.5% and re-ran the simulations.

I should note that if you are mindful of how many bets you are placing, you may want to go with a higher threshold just to help avoid suspicion from the books that you are a profitable bettor.

Assumptions and Limitations

My simulations here are not without some limitations, and I have had to make some assumptions.

The first assumption is that an individual bet will be settled before the next bet is placed. That is not reality. There is no realistic way of only running one bet at a time and waiting for those results before placing your next bet.

Another assumption that has been used is that I was betting the exact optimal quarter Kelly Criterion when making all of these bets. So, a bet of $23.41 would be a valid bet. The reality is you would round this to a whole dollar value, and probably to the nearest $5 increment. We certainly don’t want to draw attention to ourselves.

The simulation also assumes that all bets are independent. It is easy enough to only place one bet per event, and I often do that. However, if you are betting multiple times on the same event, say by betting on player props, the independence assumption is void.

Emotion can often get in the way of financial (and sporting) decisions. The ability to place the bets where you find an edge for the amount suggested by the Kelly Formula when you are on a winning streak, a losing streak, or a sideways streak can be a challenge. Betting against your favorite team can also be a challenge. Keeping emotion out of your value betting is crucial.

The last significant assumption is that all bets made were able to be placed at the dollar amount suggested. This is not always the case, especially for some of the ‘runaway’ trials that seemed to give great (unrealistic?) returns.

There are limitations too. Most importantly, this is all based on my results. Your results may vary, and yes, you may lose money.

However, for illustrative purposes, I still think there is value in showing what is possible with value betting.

Conclusions

Mathematically, value betting can be a profitable side hustle. It requires you to have the initial money, time, and effort to put in to make it work. It also requires the tools to consistently find an edge (OddsJam is a great tool) to beat the books.

The more bets you place, the higher than chances of overall profit. Do not judge your results until you have a large enough sample size.

Using the Kelly Criterion for bet sizing significantly reduces the chances of completely ruining your bankroll. And, over time, it helps to grow your bankroll at an exponential pace.

As a side hustle, now is a great time to start value betting, especially if you have access the growing market in the United States and the books that operate there. If you are ready to become a profitable sports bettor, I do recommend checking out the free trial of OddsJam. Who knows, maybe you will be the one to enjoy that runaway success.

Contact Me

Questions about how all of this works? Feel free to email me ben@beyondtheev.com You can also hit me up on X (Twitter) @BeyondTheEV if you ever have any questions about anything to do with OddsJam or want to follow along a bit more closely with my journey.

Disclaimer: Links to OddsJam are affiliate links and I am not hiding that. I truly believe in their product and use it daily. Visit OddsJam for a 7-day free trial and see for yourself. Take 35% off your first month with coupon code Beyond35 and really explore what OddsJam is all about.

Pingback: OddsJam Betting Results for Week 25 of 52 - Beyond The EV

Pingback: OddsJam Betting Results for Week 28 of 52 - Beyond The EV

Comments are closed.